Smart technology that speeds up your working capital

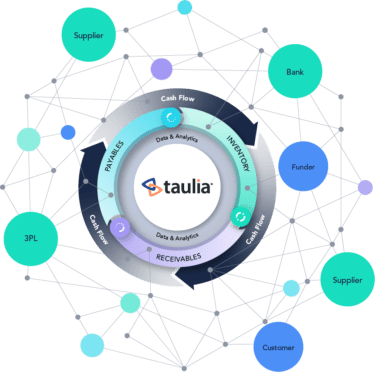

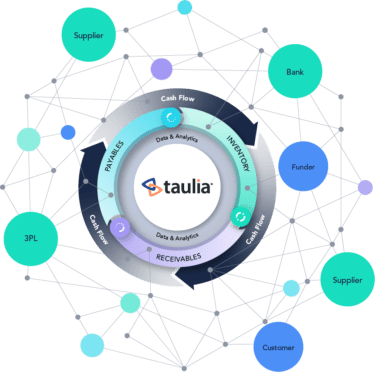

Save time on setting up individual connections by joining the Taulia Network, which connects you to an established ecosystem of buyers, suppliers, and funders.

Save time on setting up individual connections by joining the Taulia Network, which connects you to an established ecosystem of buyers, suppliers, and funders.

Taulia helps businesses large and small get the liquidity they need when and where they need it. We do so with our vast experience, global reach, and partnerships with the best in both finance and technology.

The Taulia Network provides the infrastructure for smarter cash flow choices so your business can unlock working capital and thrive.

Easy connectivity fosters more efficient cash flow management. Taulia can support growth in an efficient and scalable way by connecting buyers, suppliers, and funders under one umbrella.

The Taulia Network seamlessly connects all parts of the liquidity ecosystem, enabling access to a multitude of funding options to accelerate your cash flow without limits.

Taulia’s solutions are designed to suit suppliers of all sizes so you can achieve your goals with just one provider. With over $800bn transacting on our platform annually, we bring the technology and expertise to meet the needs of the world’s largest enterprises.

Collaboration between buyers, suppliers, and funders is fostered through seamless integrations with your operational systems that result in increased efficiency, accuracy, and freed resources.

“We saw at least a 2.5x ROI over and above making investment decisions on our cash, borrowing in the market, including spending money on the program itself.”

François Coetzee

Project, Bank and Cash Manager

Accelerate your cash flow today.