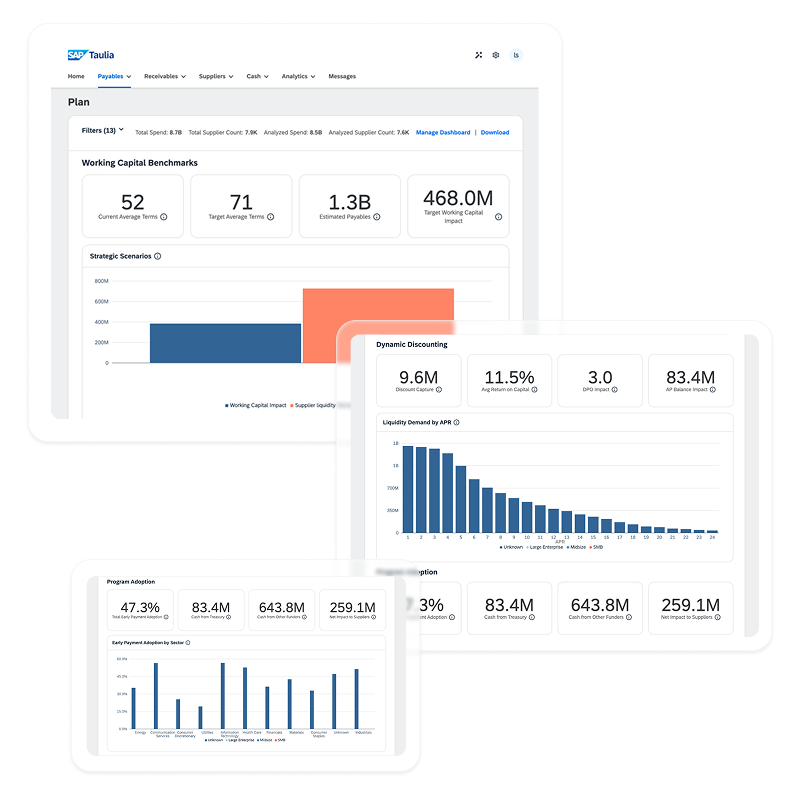

Achieve your working capital goals

With SAP Taulia’s seamless and comprehensive ERP integration capabilities, extensive funding network, and dedicated expertise, your legacy payables program is a thing of the past.

Maximize value with Dynamic Discounting,

Supply Chain Finance, and Virtual Cards

DSO deep dive

Find out more about your Days Sales Outstanding, and use our tool to analyze how it can be improved.

A payables program for efficiency and growth

Start driving efficiency, minimizing costs, and strengthening your financial position with a payables portfolio program that scales with your needs.

Faster access to funds at affordable rates

Enhance supplier liquidity and build stronger partnerships to create a strong supply chain.

Improved visibility and intelligent spend analysis

We offer real-time insights into payment options, enabling seamless cash flow management, maximized returns, and stronger supplier relationships.

Easy ERP integration

Reduce burden with seamless integrations within SAP ERP, SAP S/4HANA, and more, and a single connection point with world-class security.

See how our customers succeed…

How Sasol achieved 2.5x ROI through delivering a new payment process to their suppliers in an integrated single platform for managing all payment processes.

Read the customer story →

How Telkom unlocked 1.9 Billion Rand by delivering a new Supply Chain Finance program to their suppliers.

Read the customer story →

Helping Bridgestone build a sustainable supply chain through an innovative approach to financing.

Read the customer story →

To help achieve its working capital goals, REWE Group leverages SAP Taulia as its primary Multifunder early payment platform.

Read the customer story →Frequently Asked Questions

Contact us

Find out more about SAP Taulia.

Click the link below to send us an enquiry, one of our experts will be in touch to help.