Cash-flow optimizer

Maximize the return on commercial credit by holding onto cash longer and earning rebates on more of your spend when you consolidate payments with SAP Taulia Virtual Cards.

Secure payment controls

Avoid fraud, establish control, and reduce complications common to errors in payment timing, amount, and frequency.

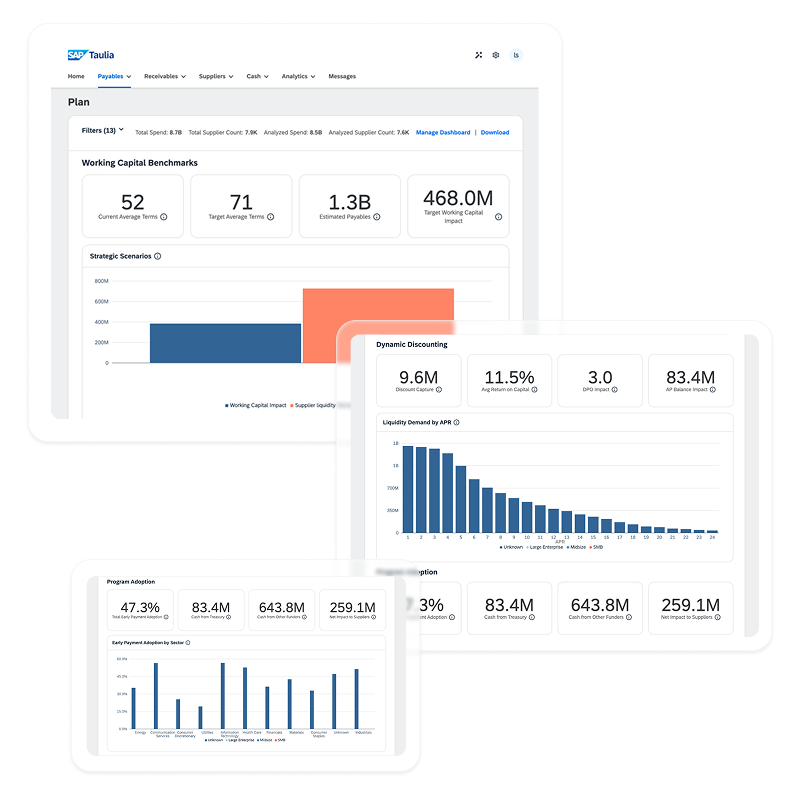

Transparency and value-added tools

Suppliers can access rich remittance detail, current and historical, while Cash Analytics leverages real-time data and AI to assess future initiatives and adapt with actionable insights.

Streamlined for SAP and beyond

Ours is the only Virtual Card solution that comprehensively integrates with your Oracle and SAP ERP without any IT project support. This extends to all ERPs, resulting in a seamless connection.