Blog

Expert Advice

5 min read

10 Dec 2024

Blog

Expert Advice

5 min read

10 Dec 2024

In the wake of economic uncertainty, many companies have experienced a degradation in key working capital metrics. This has a direct impact on liquidity, pressuring companies to optimize their liquidity management strategies to seize growth opportunities and establish long-term financial stability. To counter this turbulent period, companies are adopting proactive strategies, such as improved working capital management, enhanced cash forecasting, strategic financing, and the use of technology and automation.

Given the degradation in working capital metrics, CFOs and finance teams are optimizing components of working capital to improve liquidity and ensure operational stability. To enhance Accounts Receivable (AR) management, companies are refining credit policies and improving the efficiency of cash collections. This involves closer collaboration between finance and sales teams to ensure credit policies are aligned with the company’s liquidity requirements, encouraging timely payments from customers.

Additionally, companies are leveraging AR financing, such as factoring or invoice discounting, to convert outstanding invoices into cash more quickly. This approach helps maintain liquidity, particularly in sectors where payment cycles tend to be longer.

In response to supply chain disruptions and the need to maintain liquidity, companies are optimizing their inventory management strategies. Excessive inventory ties up cash that could otherwise be used for critical business needs. Consequently, businesses are using inventory financing to optimize their balance sheet while still keeping sufficient inventory.

Where possible without disrupting sales, companies are leveraging just-in-time (JIT) inventory systems or demand-driven inventory models to reduce inventory levels while still meeting customer demand. Along with the use of predictive analytics and inventory optimization tools, companies can forecast demand more accurately and maintain lean inventory levels to boost overall liquidity.

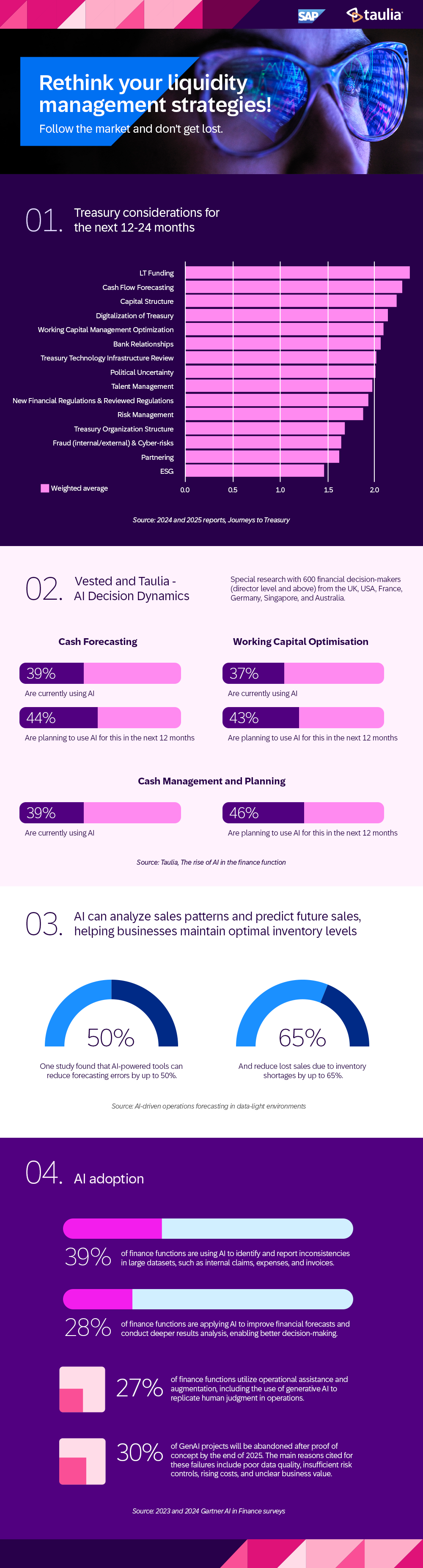

The volatility in working capital metrics has underscored the importance of accurate and real-time cash flow forecasting. Companies are investing in enhanced cash forecasting tools and processes to improve their ability to predict and manage liquidity needs, such as advanced data analytics tools that give real-time visibility into cash positions across the organization. By facilitating the accurate tracking of inflows and outflows, finance teams can anticipate liquidity shortfalls before they occur.

It is important to note that real-time cash visibility is crucial for industries with complex supply chains or seasonal demand, where cash flow can fluctuate significantly. With up-to-date insights into the company’s cash position, CFOs can make more informed decisions regarding capital allocation and operational spending.

To prepare for future uncertainties, many companies are incorporating scenario planning and stress testing into their liquidity management strategies. By modeling different economic, market, or operational scenarios, finance teams can assess how various factors, ranging from supply chain disruptions to changes in customer payment behavior, will impact cash flow and working capital. This approach allows companies to identify potential liquidity risks and develop contingency plans to address them. For example, if a company forecasts a potential shortfall in cash due to delayed customer payments, it can preemptively seek alternative funding to avoid a liquidity crunch.

Digital transformation is playing an increasingly important role in liquidity management. By adopting automation tools and financial management platforms, CFOs can streamline processes, reduce manual errors, and accelerate efficiency. Many companies are investing in Treasury Management Systems (TMS) that integrate cash flow forecasting, payment processing, and liquidity tracking into a single platform. These systems offer real-time data and reporting, enabling CFOs to monitor cash positions more effectively and respond quickly to changes in working capital metrics.

Furthermore, AI and machine learning tools are being integrated into digital transformation strategies to enhance liquidity management. These technologies can analyze historical data and identify patterns in working capital behavior, helping CFOs predict future cash flow trends.

In response to declining major working capital metrics, companies are transforming their liquidity management strategies for financial resilience. By optimizing working capital, enhancing cash flow forecasting, adopting advanced technology, and building strategic liquidity buffers, many companies are taking a more proactive approach to managing liquidity amidst economic uncertainty. These strategies provide the flexibility needed to adapt to changing market conditions and capitalize on growth opportunities as they arise.

CFOs, get ready for the next year. Download SAP Taulia’s newly released e-book, The Road Ahead: 2025 Trends & Insights for CFOs.

Expert Advice

Getting the best performance from your suppliers, while also ensuring you’re contributing towards a stable long-term relationship, can pay off…

Expert Advice

Adopting the following supply chain management best practices can lay the groundwork for a successful strategy and build a supply…

Expert Advice

Healthy cash flow is vital to the overall resilience of a business, determining its ability to pay bills on time,…