What is strategic sourcing?

Strategic sourcing is the term used to describe a strategic approach to the sourcing process. It involves the same fundamental steps – research, analysis, negotiation, contracting, and onboarding of new suppliers to fulfill demand for goods or services – but is oriented to contribute to broader business objectives. It also often includes a greater reliance on data or technology.

The sourcing process is part of the larger procurement cycle and is a critical factor in its success. Taking a strategic approach to sourcing can significantly improve supply chain efficiency and help reduce supply chain costs, while also working towards achieving overall operational aims. This can be done through actions that strengthen supply chain resilience, minimize purchasing costs, or prioritize healthy supplier relationships.

By considering the implications of sourcing decisions strategically, businesses can amplify their positive effects. Aligning sourcing activities with broader business strategy means that the outcomes don’t just improve the sourcing process itself. It ensures that they also contribute meaningfully to procurement, accounts payable, and manufacturing KPIs.

That makes it an important consideration for businesses looking to get the most out of their supply chain. The effects of adopting a strategic approach to sourcing can ripple throughout operations to drive efficiency, growth, and resilience.

What is sourcing?

Sourcing is the process that kicks off the procurement cycle. It begins with identifying, researching, vetting, and selecting suitable suppliers. It then continues with the negotiation of contractual terms and the onboarding of selected suppliers. In short, it’s the process that determines what suppliers are chosen to meet internal demand for goods and services, and how they’re managed in the early stages of the relationship.

A non-strategic approach to sourcing is the de facto state of play. Without considering broader strategy, sourcing only serves its own objectives. In other words, it acts as a self-contained process.

However, that approach ignores the inevitable impact that decisions made in the sourcing process have on other elements of business operation. The suppliers chosen to fulfil demand for goods or services implicitly affect the rest of the procurement process, while also impacting other departments including accounts payable and manufacturing.

This explains strategic sourcing’s rise in popularity. As supply chain performance and health becomes more critical to overall business performance, the supplier selection, contractual negotiation, and onboarding processes all become more important.

Sourcing vs procurement

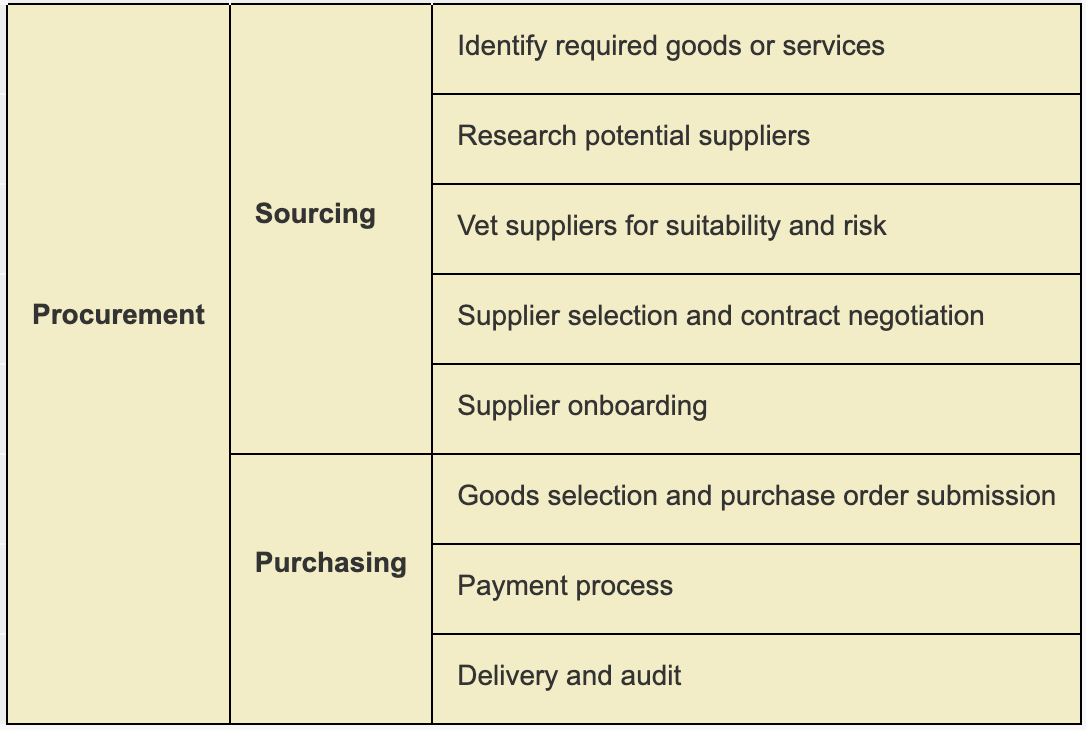

Sourcing and procurement are not interchangeable terms. Sourcing is part of the larger procurement process, making up the earliest steps. When the sourcing process ends, the procurement cycle continues with the purchasing process.

This is easier to understand by looking at the complete procurement process through the lens of the two smaller processes that make it up:

Sourcing is concerned with establishing the supplier base that makes up the supply chain. The broader procurement process extends beyond that aim to also consider how best to handle supply chain management, including managing existing suppliers, inventory, and accounts payable.

The strategic sourcing process

Set sourcing objectives

Strategic sourcing begins with a step not fully present in a non-strategic sourcing process: establishing objectives or KPIs that outline concrete aims. This is a big part of what differentiates the two approaches.

These objectives can be diverse depending on the business adopting them. Some businesses will prioritize a sourcing strategy to build redundancy into the supply chain, onboarding multiple suppliers for core goods or services to achieve resilience to supplier risk. Others might decide that their sourcing strategy should contribute towards broader operational cost reduction aims, prioritizing finding low-cost suppliers and reliable service.

Identify required goods or services

The next step is to determine what goods or services are required. This will influence the direction of the sourcing process in the future, determining what types of suppliers need to be sourced.

In strategic sourcing, this part of the process will often involve the analysis of historical data. Using technological solutions, businesses can review their historical procurement data to get deeper insights into the goods and services they’ve purchased in the past, the suppliers who provided them, and the value attained.

Research potential suppliers

With a clear understanding of what goods or services are required from suppliers, businesses can move on to assessing the market and researching potential vendors. How this step is approached depends on the sourcing objectives. If cost reduction is the priority, for instance, research will be focused on finding suppliers who can offer the best value.

Technological platforms can be helpful here, too. Using a centralized digital solution like Taulia to identify and research suppliers, you can get an overview of the options more quickly and efficiently.

Vet suppliers for suitability and risk

Having shortlisted a selection of suppliers who appear to be a good fit for their needs, businesses can move on to a more rigorous vetting process. This typically involves making first contact with the supplier and having a pre-contract discussion. It may also include detailed background and financial health checks to identify supplier risks and determine how much of a threat they pose.

Supplier selection and contract negotiation

So far, the process should have led to a clear best supplier choice out of the original selection researched. At this point, they can be formally selected as the preferred supplier, and contractual negotiation can begin.

Businesses should hold their sourcing objectives front-of-mind in negotiations, ensuring that the agreed-upon terms are cohesive with the established aims. This may be reflected in payment terms, delivery timeframes, and more.

Supplier onboarding

Finally, the supplier can be onboarded, and the relationship properly begins. During the supplier onboarding process, a comprehensive approach is beneficial. Ensuring all supplier information is collected accurately, systems and processes are transparent, and the right internal stakeholders have access to the communication channels they need can all contribute to laying a solid foundation for a productive partnership.

Using a supplier management platform offers significant advantages in this arena. It can help make supplier information and relationship management more effective while improving communication accuracy and timeliness.

How to improve strategic sourcing

Adopting a more strategic approach to sourcing is an improvement, bringing about a more sophisticated view of what is a fundamentally critical part of supply chain operations.

However, even having adopted strategic sourcing as a base principle, there are often ways of making the approach more effective. They include:

- Utilizing technology. Using supplier management software, e-tender technology, and data analysis can significantly improve the efficiency of strategic sourcing. Leverage all the technology you have at your disposal to get the most out of your sourcing activities.

- Focusing on outcomes. Rather than getting carried away with the sourcing process, remember what you’re doing it for. Disseminating core objectives to stakeholders and monitoring sourcing KPIs can help you stay focused on your established aims.

- Maintain the approach. Sourcing responsibilities don’t necessarily end when new suppliers are onboarded. A culture of constant monitoring and performance analysis should be instilled to ensure that suppliers continue to make sense in the context of the established sourcing objectives and those of broader operations.

The benefits of strategic sourcing

Adopting a more strategic approach to sourcing and focusing on continually refining the process offers a broad range of benefits. They include:

- Better process continuity. Adopting strategic sourcing requires you to rethink your sourcing process in general. This inherently means you’ll be working on establishing a more formal way of doing things, which means that sourcing activities will become more consistent and, therefore, more manageable.

- Improved risk management. Setting clear sourcing objectives and using data or technology to more rigorously vet suppliers against them means you’ll be less likely to choose suppliers who pose a risk to your operations. This should be reflected in better supplier suitability and fewer supply chain issues.

- Better supplier relationships. Strategic sourcing means you’re more likely to choose suitable suppliers, which in turn means you’re likely to have better relationships with them. As you’re also expected to take a more sophisticated, objective-led approach to contract negotiation, you should settle on terms that reduce the likelihood of future disputes.

- Alignment with business objectives. Most importantly, strategic sourcing means your sourcing process will contribute to broader business aims. This can create widespread improvements to operational outcomes. Sourcing will be a core part of the supply chain strategy in the future and has the potential to offer significant benefits.